Mergers and acquisitions are a key strategic lever to propel your company’s growth. They are complex, stressful, time-consuming bets with no guaranteed outcome. And there’s no changing this – it’s the nature of the work. What organizations can influence, however, is whether the time invested in the M&A process is productive, seed-sowing work that yields a high-value “harvest” at the end – not a barren crop.

What makes the difference? A structured, planned and phased approach to navigate the many M&A variables. In other words: a playbook.

What is a M&A Playbook?

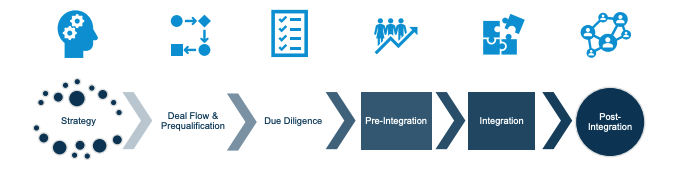

An M&A Playbook is a company’s published, end-to-end approach to executing a successful M&A deal. The playbook includes activities, best practices, tools, templates and language that connects to the company’s strategic plan. It addresses every stage of the M&A process: from determining if M&A is, in fact, the best way to meet strategic goals, to planning the full integration of companies, through to post-integration learning and capturing long-term value. The playbook is typically comprised of six phases:

Why are M&A playbooks critical?

As organizations look to fulfill their growth objectives, they rarely have all of the necessary in-house talent, expertise and resources to do so. Typical solutions are to buy, build, or borrow to close this gap. Of these, the “buy” solution – to be bought by or to merge with another company – can be the intended solution. And yet, mergers and acquisitions (M&A) often do not deliver the value they were intended to create.

“M&A is a mug’s game, in which typically 70%–90% of acquisitions are abysmal failures”

Studies show that companies with a well-structured M&A process (i.e. a playbook), however, have a much higher likelihood to achieve their desired outcomes, compared to those who do not.

Sharing our experience

Stratford works with hundreds of companies a year. In our experience, “pockets” within an organization sometimes understand certain aspects of the M&A cycle – but rarely is an entire, end-to-end plan created that provides a structured, repeatable and accountable approach to the entire procedure. Rarer still, is this plan clearly articulated so that all relevant stakeholders including your board, understand the big picture.

How your business can change with a playbook

Before Calian created their clearly-articulated M&A playbook, Kevin Ford, CEO of Calian Group, stated that they were misaligned as a management team, wasting precious time internally and trying to reach consensus with the Board. Creating a playbook significantly improved Calian’s M&A efficiency (decision-making, consensus-building and implementation speed) and effectiveness (success rate and value derived from the deal).

Based on years of experience, we’ve put together an M&A checklist that covers the key “plays” that Stratford uses on every successful M&A. If a merger or acquisition is on your company’s horizon, you may find the check list helpful in developing your own M&A playbook which can support better decision-making, consensus-building, improved implementation speed, success rate and most importantly realizing value derived from the deal.

This article was published more than 1 year ago. Some information may no longer be current.