As a CEO or business owner, you might feel like you’re working hard to make sure that everything is running smoothly. Instead of merely putting out fires every day (working ‘in’ your business), have you taken the time to consider what elements truly drive value when it comes to running a successful – and valuable – company (working ‘on’ your business)? Evaluating these primary drivers objectively can provide insights into where potential weaknesses lie – and reveal opportunities for improvement.

This month we’re introducing our Value Builder Assessment which can help give you a perspective as to whether or not your company could benefit from improving certain value drivers further.

Recently, I had the opportunity to speak to a group of TEC leaders on the topic of M&A and value enhancement.

The discussion on valuation enhancement was of significant interest to executive leaders and business owners. Whether your business is pursuing growth or planning an exit, a strategy which incorporates focus on areas which increase the value of your business, makes good sense.

The owners were invited to take our business assessment which provides a report of how they score on a scale relative to industry peers based on NAICS code. This exercise really highlighted where the CEO’s needed to focus and alerted to them to an approach perhaps they had not considered recently.

Thinking about your business in this manner not only supports an eventual exit but drives a long term sustainable company.

Time to work “on the business” vs. “in the business”.

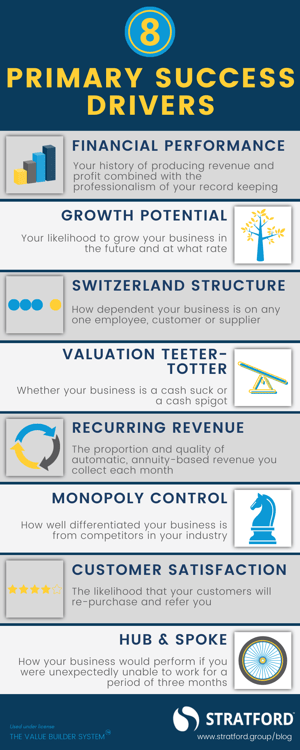

Leveraging our tool from Value Builder, we focus on eight primary business drivers.

In our recent example from the TEC group, we found that there were three areas that were the greatest opportunity to enhance value.

Monopoly Control – how well is your value proposition differentiated from it’s competitors. This will drive a competitive advantage which may translate into premium pricing and drives long term sustainability.

Recurring Revenue – historical repeatability of revenue, or contractual models such as Annual or Monthly Recurring Revenue provides evidence of future revenue assurance. It is no surprise that SaaS companies with low churn rates of business are driving higher multiples.

Financial Performance – surprisingly some companies scored lower than expected. Paramount to financial performance is having adequate financial records and controls but also evidence to support this such as an annual audit.

I invite you to take our business assessment or feel free to reach out to us directly.

You May Be Interested In | The Owners Metric

Stratford Management Consulting has worked with companies of all sizes to assist with meeting their business objectives and growth targets. Combining years of expertise with an emphasis on strategy and execution, we work with your company to move you to the next level in a sustainable manner.

Reach out to us today to see how we can help you achieve your potential.