Achieve Better Results

Value-focused management consulting solutions to accelerate results and build enduring capabilities.

Trying to keep up with changing market trends and manage your business’s growth can be difficult.

Executives are often overwhelmed by the challenge of focusing on the most important areas of their business while also meeting their performance objectives.

With trusted advisors by your side, you don’t have to embark on this journey alone.

Stratford Management Consulting makes it easy for executives to access the expertise and resources they need to achieve organizational goals and reach desired outcomes faster through customized solutions.

Transform Goals Into Results

Prioritize & Focus

Get Expertise

Add subject matter expertise and objectivity to develop, implement and achieve your strategic objectives.

Accelerate Results

Trusted by

Leading organizations and executives to make a lasting impact on performance

"Stratford Group has been an indispensable partner in our journey towards transformation at the Medical Council of Canada. Their adept facilitation of corporate strategic planning sessions has brought clarity and alignment to our organizational objectives. Moreover, their expertise in guiding us through an IT strategy review and workplan development has been instrumental in setting a path for our technological infrastructure. What sets them apart is their commitment to being more than consultants; they are true partners, deeply invested in our success and dedicated to driving impactful business transformation initiatives.."

Dr. Viren Naik

CEO

Customized Solutions

“Colleen and Carlos from the Stratford Group are a dream team. I would recommend the Stratford Group for anyone seeking a smart partner to guide strategic planning. Their attentive approach, deep understanding of our unique business model, and ability to relate to and quickly learn and incorporate insights from all stakeholders were instrumental in delivering precisely what our team needed. Their dedication and expertise have set us on a path to long-term success..

![CDP_5Year_Logo_moreMission_greenFade[8]](https://www.stratford.group/hs-fs/hubfs/CDP_5Year_Logo_moreMission_greenFade%5B8%5D.png?width=200&height=125&name=CDP_5Year_Logo_moreMission_greenFade%5B8%5D.png)

Michal Heiplik

President & CEO

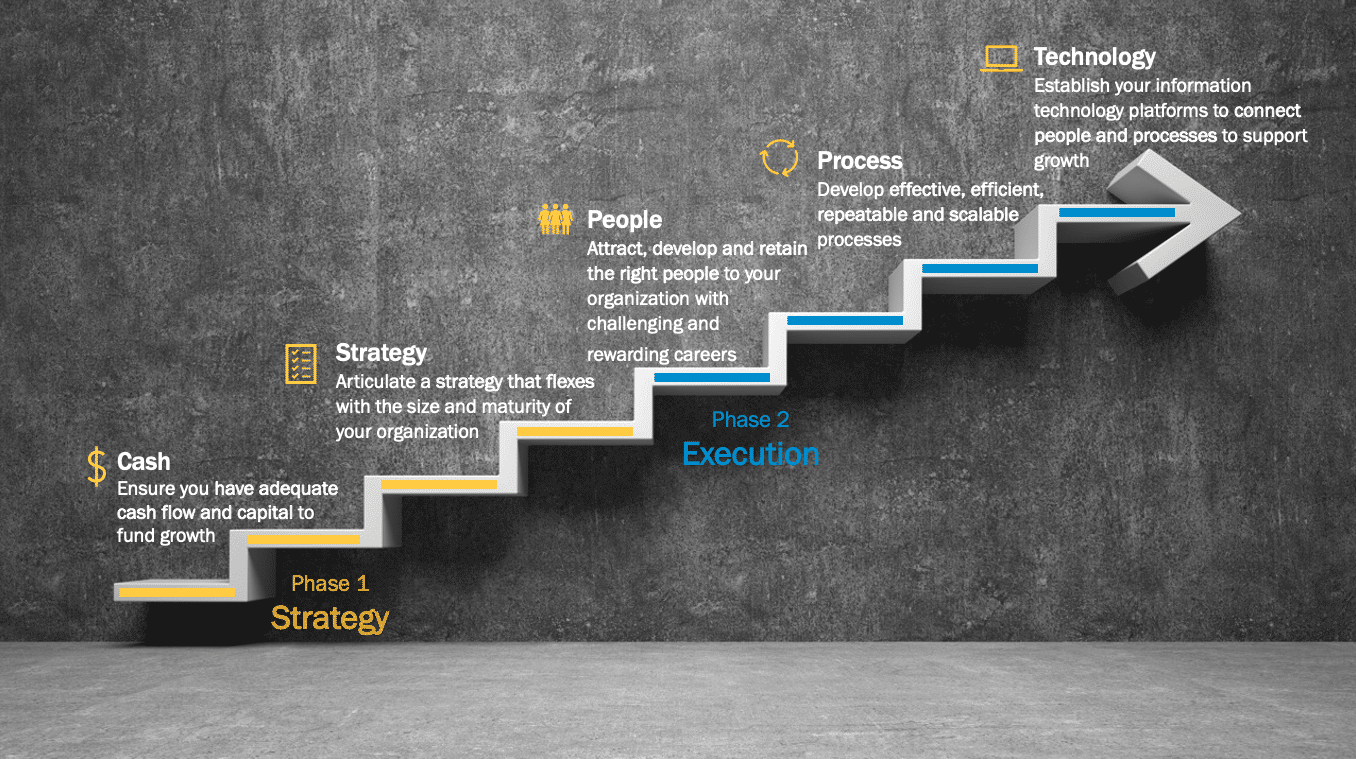

Get the Right Things In Place To Scale Your Business

Solutions that deliver value with an outside perspective to help you understand where you are and where you'd like to be.

Trusted by

Leading organizations and executives to make a lasting impact on performance

2025 Global Business Trends

Stratford Group and the KNBA join forces to connect top executives in Canada’s largest tech park

Learn how Stratford Group and the KNBA collaborated to create the Hub350 leadership councils to provide an opportunity for local tech CEOs and c-suite executives to connect and discuss common problems.

A Complete Guide For M&A Success

- How to build a framework to help you navigate the many M&A variables

- How to take a structured approach to compile the necessary documents for your data room

- Tips and tricks to help propel your M&A strategy and support better decision-making through realized value

Ready to Achieve Better Results?

Step 1

Engage Stratford

Simply reach out to us and tell us about your challenges. We'll quickly respond with a team of trusted business advisors to deliver you the advice and support you need.

Step 2

Customize Your Solution

Your team of advisors will work with you to develop a phased, structured and efficient approach with proven tools and methodologies to help you reach your goals.

Step 3

Implement Your Solution

Working alongside your team, we'll roll up our sleeves and provide you with the support necessary to operationalize, implement and measure your results.

Step 4

Achieve Results

We'll help you put in place the right performance management systems and KPIs to monitor results and accountability to ensure enduring results and improvements.