A Patent Landscape Analysis (PLA) helps organizations position R&D for growth by identifying opportunities, competitors, emerging technology clusters, and high-potential markets. By mapping filing trends and technology spaces, a PLA provides valuable intelligence to guide investment, reduce risk, and align innovation strategy with future demand.

What is a Patent Landscape Analysis?

Research and development (R&D) is usually the key engine of growth for small and mid-sized innovative enterprises (SMEs). Often, the SME has one or more niche products out in the market, with others in the pipeline. However, poor strategic planning of future R&D activities – or worse, none at all – often leads to the demise of SMEs. This can be mitigated, if not avoided, by the use of a valuable, but underused tool: the Patent Landscape Analysis.

A PLA will outline:

-

Where growth opportunities lie — including whitespace areas with lower patent activity.

-

Who the competitors are — and how they are protecting their innovations.

-

Which jurisdictions matter most — by showing which countries have high R&D activity and high market potential.

-

How technologies are evolving — through emerging clusters and sub-clusters in a given sector.

The Autonomous Vehicle Sector

Take for example, the Autonomous Vehicle (AV) sector. A PLA provides a patent filing timeline, which shows a 200% increase in patent filings since between 2009-2015, spurred by issues of safety, climate change and use of public cars.

Global investments—both private and public—continue to accelerate, with autonomous systems increasingly integrated into smart city planning, electrification, and AI-driven mobility solutions with a projected worldwide $87 billion AV market by 2030. The increase in demand for self-driving cars will provide for new revenue streams.

Not surprisingly, car manufacturers are the top patent filers. A PLA in this field shows:

-

- Top filers include Toyota, Bosch, Hyundai, Ford and GM, with Waymo (Alphabet’s mobility spin-off which stands for a “way forward in mobility”) climbing rapidly. With Toyota far ahead of the pack, Toyota will invest $50 million USD over the next five years researching and developing Artificial Intelligence (AI) applied to self-driving cars. The company has established centers of research at MIT and Stanford. A top-10 patent filer trending upwards is Waymo (which stands for a “way forward in mobility”). The PLA analysis indicates that overall, Japanese companies lead the world in developing AV technology.

- Non-automotive innovators such as IBM, Baidu, Apple, and Uber are also developing propriety technology in the AV sector. For example, IBM has launched a cloud-based system that uses Natural Processing Language and Machine Learning to develop insights into a large amount of unstructured data, with the goal of integrating this system into future self-driving cars. Baidu, the Chinese web-services giant, plans to mass-produce self-driving cars by 2019.

- Canadian contributions are led by QNX, which filing patents in the field of AI to help self-driving cars communicate with each other and surrounding infrastructure.

This competitive intelligence gives companies visibility into who is shaping the future of mobility, where collaborations or licensing opportunities might exist, and which areas are saturated versus open for innovation.

Technology Clusters

A PLA doesn’t just show who is filing; it breaks filings down into technology clusters to reveal how the field is evolving. It also provides a breakdown of the technology clusters that make up the AV sector. For example, the five main clusters are cruise control technology, safety mechanisms, range systems/sensors, navigation systems and connected vehicles.

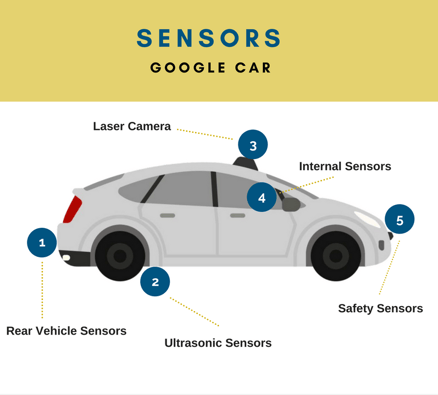

In the field of sensors, Google alone has developed proprietary technology for a rotating roof-top camera that uses laser technology; a camera at the front of the vehicle to detect cars, pedestrians, traffic lights and road signs; radar attached to the rear bumper to detect cars approaching from the rear; ultrasonic sensors at the rear wheels to monitor movement; and internal sensors to establish accurate positioning.

Each cluster, in turn, is made up of sub-clusters, which can be further explored to find areas of R&D potential. In addition, the PLA provides a trend analysis as to the growth (or decline) of R&D in a particular technology cluster or sub-cluster. Such a landscape provides valuable information for companies looking to chart a course of R&D in growth markets.

Final Takeaway

Patent Landscape Analyses give organizations the intelligence to chart their R&D with confidence. By combining filing trends, technology clusters, and competitor insights, a PLA helps you see where the market is heading—and how you can position your innovation to capture future growth.

Stratford Intellectual Property can help you transform data into strategy. Connect with our team to explore how a PLA can uncover new opportunities for your R&D.

You Might Be Interested In: Everything You Need to Know About Intellectual Property Strategy

This blog post is more than a year old. Some information may no longer be current.