Over 70 per cent of Mergers and Acquisitions (M&A) fail. Of these, estimates suggest that up to 85 per cent fail due to mismanagement of cultural issues, but it doesn’t have to be this way.

M&As are complex. Selecting the right target, completing due diligence and negotiating the financial transaction are all-consuming efforts. Once an executive team closes the deal, there can be champagne, a collective sigh of relief and hope for some respite after a long exhausting journey. In reality, the heavy lifting has just begun.

Senior executives must now devote themselves to the fiendishly hard task of integration. There are countless operational and financial issues to tackle.

Anticipating and managing cultural differences

However, failing to anticipate and manage cultural differences can undermine an otherwise well conceived plan. Perceptive executives must be on the lookout for early signs of cultural distress:

- Silos or camps forming within the two companies;

- Increasing difficulty making decisions or reaching consensus on even simple issues;

- Managers relying on familiar “trusted advisors” rather than engaging their new teams; and

- Frequent “closed-door”, secretive discussions.

In severe cases of culture dysfunction, one management team actively seeks to undermine the other. This “snowballs” as employees receive mixed messages and begin to follow the lead of their managers, creating a toxic workplace that impacts customers and suppliers.

Problems frequently start at the top. Acquired executives struggle to adjust to working with new colleagues within a new corporate culture. Some may suddenly find themselves further down the corporate “food chain” with diminished influence. Freewheeling executives from a private, entrepreneurial company may now be part of a larger public corporation with stifling new policies, oversight and audit requirements. It is a delicate task for the incumbent management team to maintain compliance without alienating the acquired team.

Successful integration demands effective change management. To begin, a structured communication plan is required that includes frequent one-on-one meetings with key managers and individual contributors. This fosters relationships and ensures that new staff members feel they have a voice in integration decisions. Equally important, is proactively and widely acknowledging cultural differences and intentionally establishing new norms for the combined organization.

You can successfully merge two companies and their cultures, but not without an explicit cultural integration program. Add it to the integration “to do” list along with the other synergy targets. Start with sensitivity training and consider involving an external expert to help bridge the divide.

Our approach for a successful integration

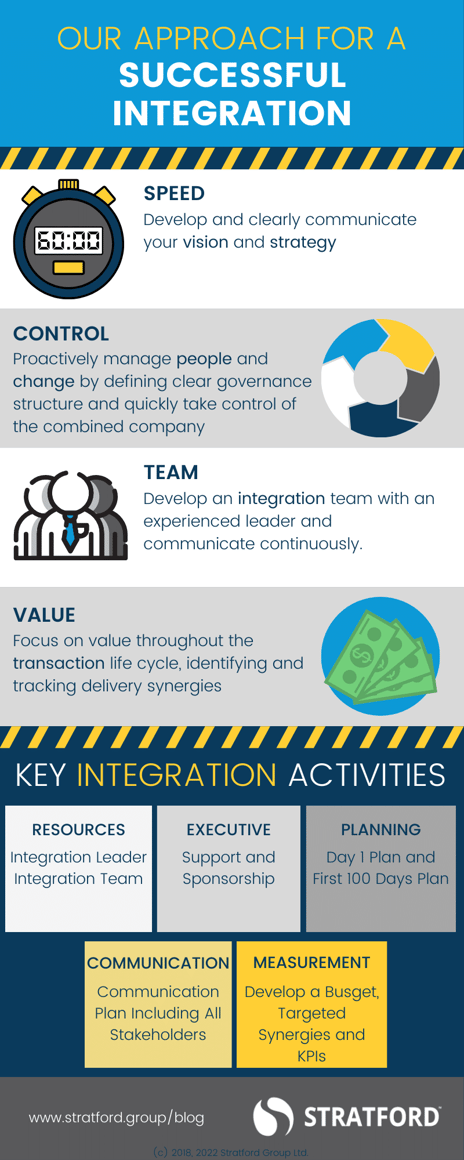

To help you with this next phase of the M&A process, Stratford Managers has outlined our approach for a successful integration focused on:

- Speed: Develop and clearly communicate your vision and strategy;

- Control: Proactively manage people and change by defining a clear governance structure and quickly take control of the combined company;

- Team: Develop an integration team with an experienced leader and communicate continuously; and

- Value: Focus on value throughout the transaction life cycle, identifying and tracking delivery synergies.

In addition to these areas of focus, there are key integration activities to be undertaken, including:

- Resources: Appoint an Integration Leader and Integration Team

- Executive support and sponsorship: To help define process, communication and expectations

- Planning: Develop a Day 1 Plan and First 100 Days Plan

- Communication: Create a comprehensive communication plan to include all stakeholders

- Measurement: Develop of a budget, targeted synergies and KPIs.

This may seem obvious to managers that have already sailed the stormy waters of M&A integration. For less seasoned executive crews, it requires a steady hand at the helm to navigate around the cultural rocks upon which so many acquisitions flounder.

You May Also Be Interested In:

- Stratford Managers’ client Nordion closes deal;

- Stratford Managers’ client Martello announces reverse takeover;

- Stratford Managers’ client ADGA Group’s recent wins; and

- Stratford Managers client Baylin concludes successful $49 million M&A.

About Colleen:

Colleen Kelley is Vice President and Practice Lead of Business Operations at Stratford Managers. She is a seasoned executive with over 25 years of experience in both high-tech OEM and contract manufacturing sectors. She is an engaging leader with substantive skill in profit and loss management, customer orientation, program management and supply chain management. She also brings significant experience in merger and acquisition activities, as well as leading organizations through substantial transition.

[UPDATE: As of Jan. 15, 2021, Ottawa’s Stratford Managers Corporation has become Stratford Group Ltd.]

This article was published more than 1 year ago. Some information may no longer be current.